Resistance and capacitance components info

According to the latest market report, the delivery time of passive components has stabilized, but due to the shortage of raw materials affecting manufacturers, some product delivery times will be extended as prices rise. At present, the average delivery time for passive components from various manufacturers is 19-38 weeks.

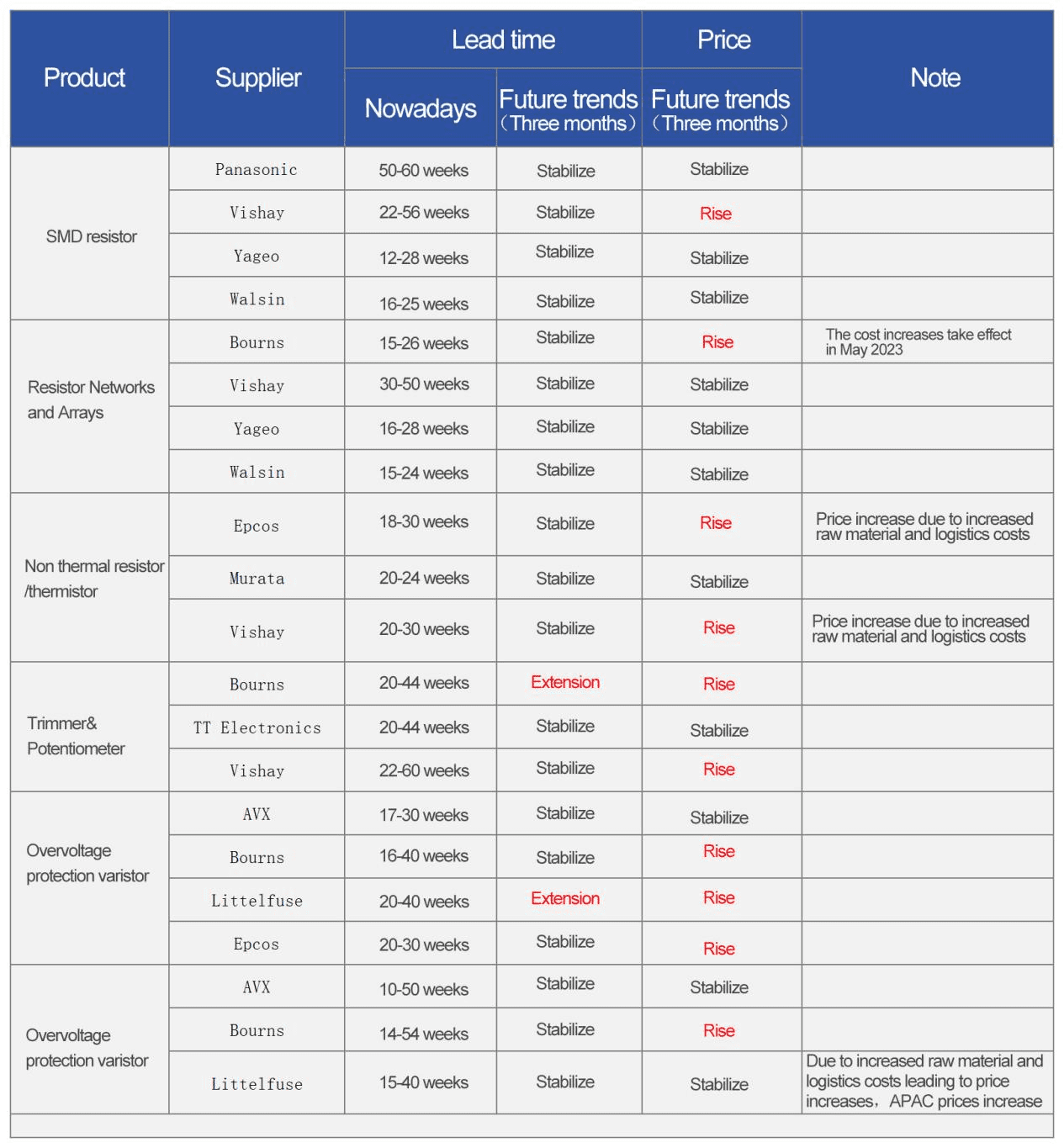

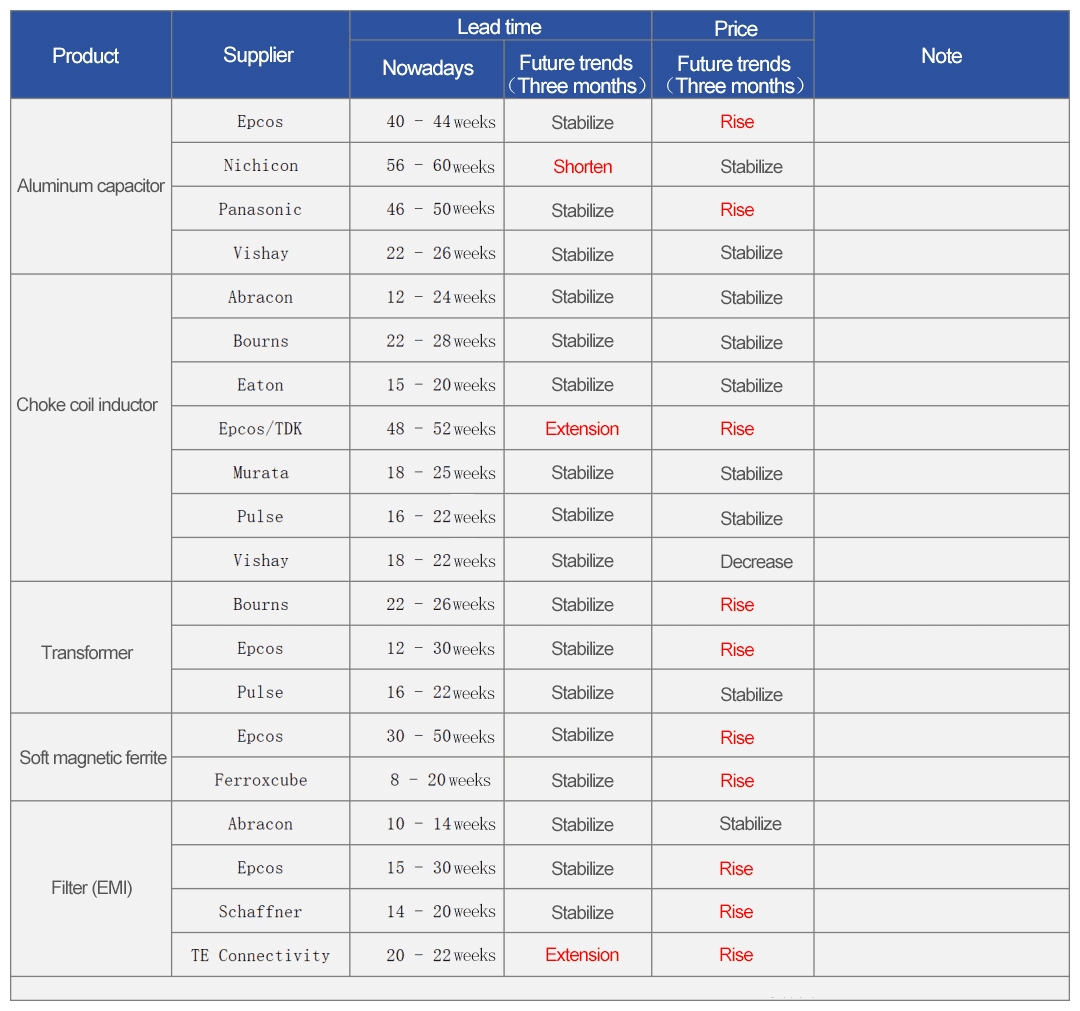

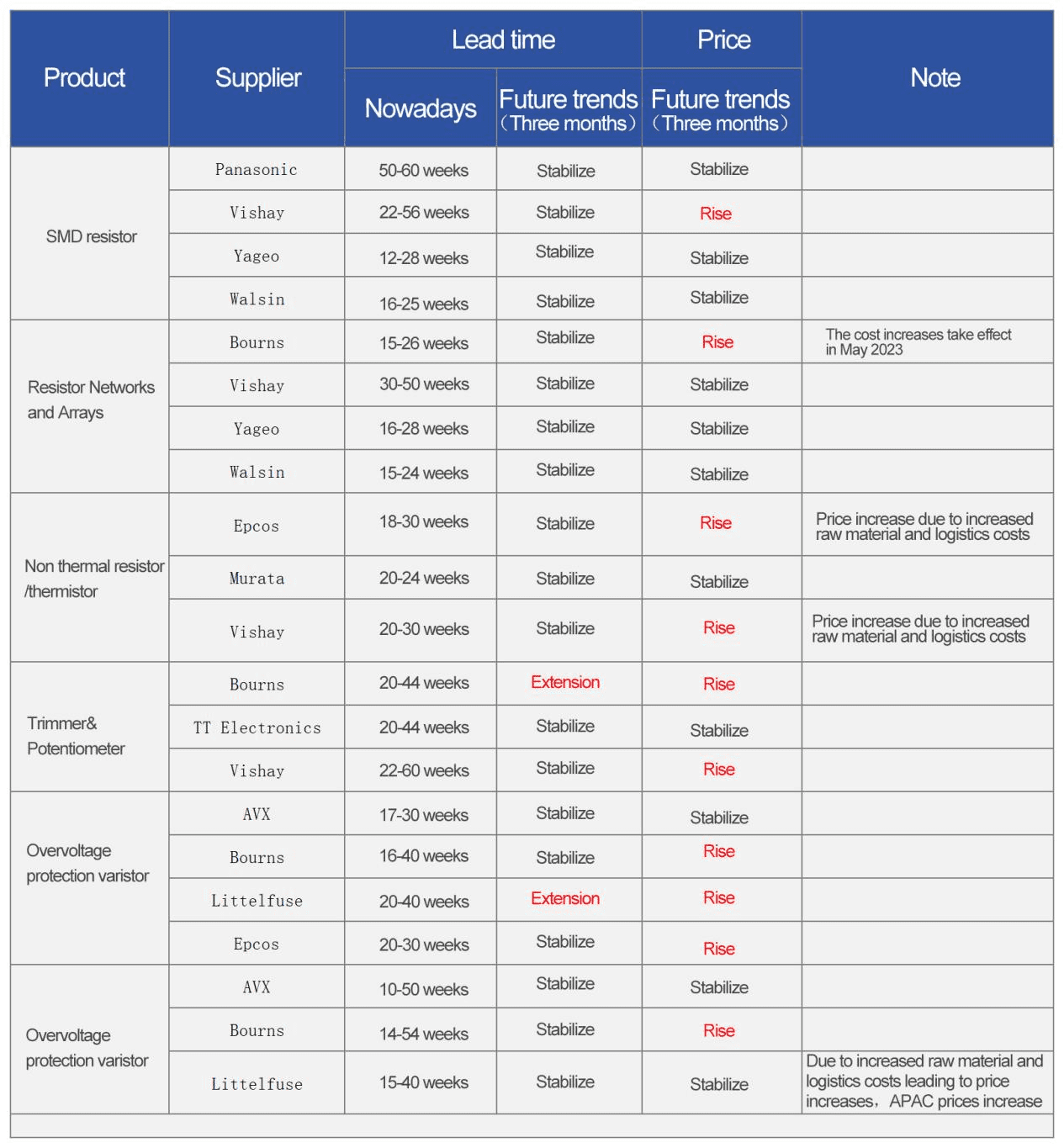

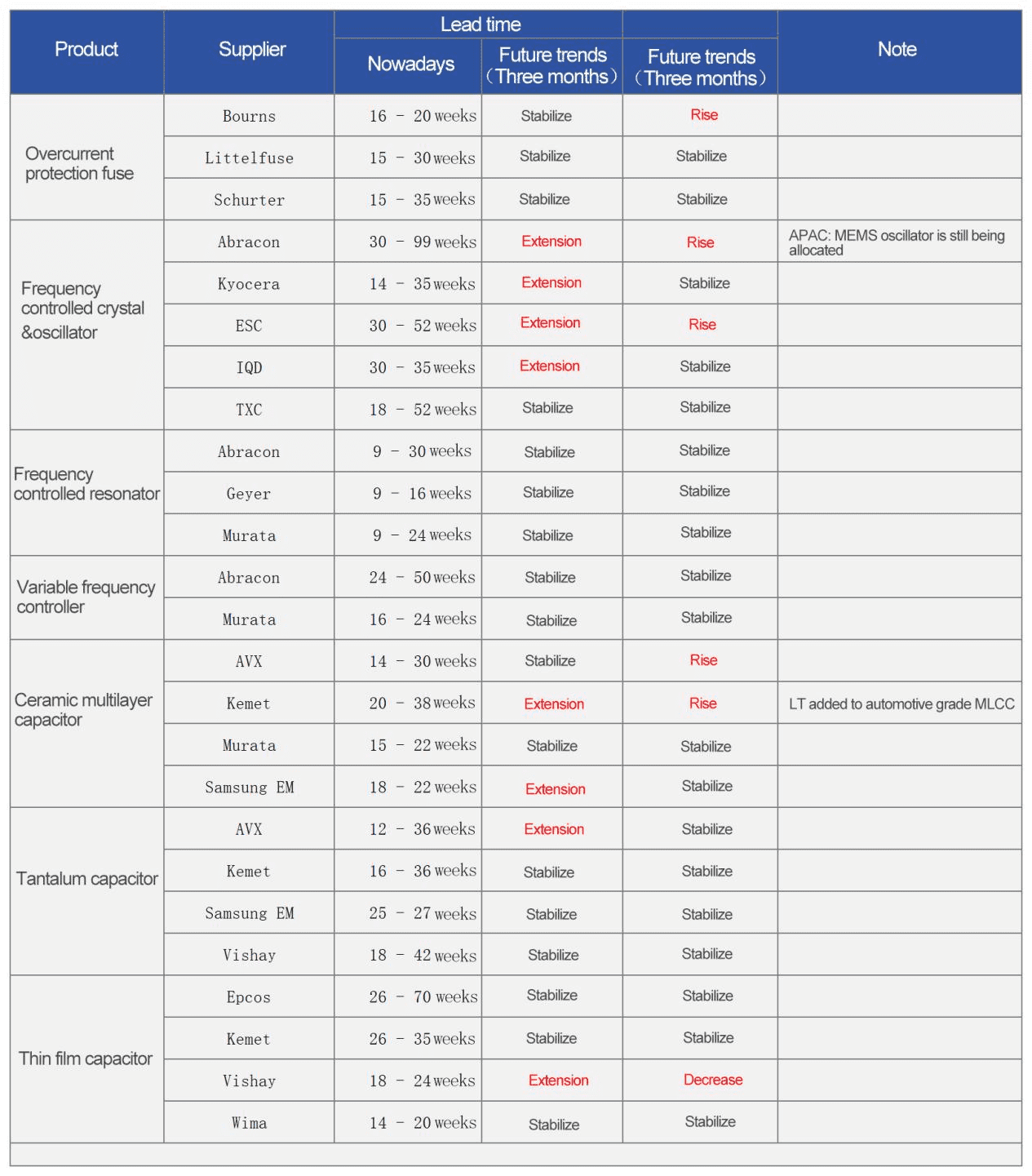

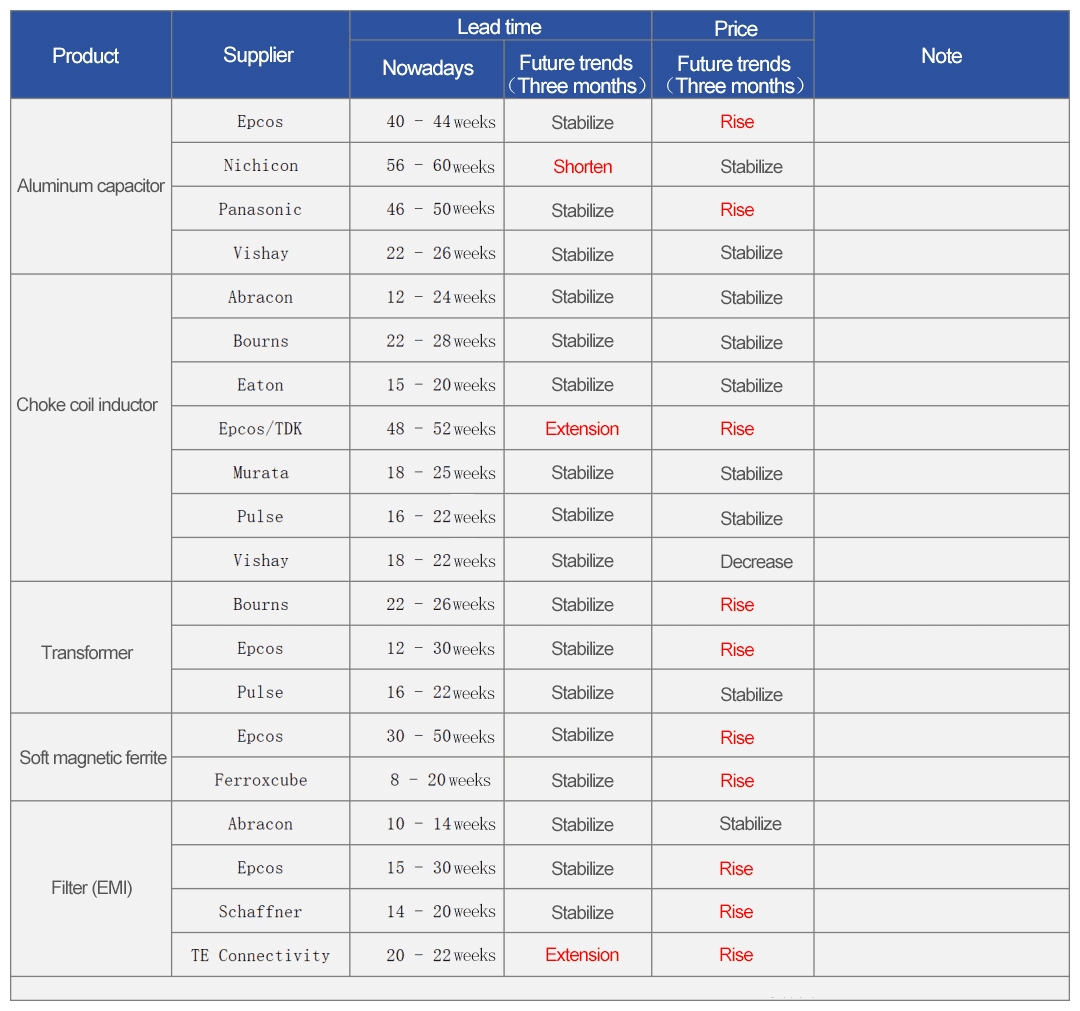

The following are the delivery dates and price trends for the future passive component market in Q3

Bourns pointed out that the insufficient supply of ceramic materials has led to an increase in the prices of trimmers and potentiometers.

Due to the increase in raw material and logistics costs, Litteluse announced an 8% price increase in April for overvoltage protection varistors, overvoltage protection thyristors, TVS diodes, and overcurrent protection fuse products in the European Union and Asia Pacific region. Epcos has also increased the price of overvoltage protection varistor product lines. The price of Walsin's automotive grade SMD resistors is decreasing in the European Union.

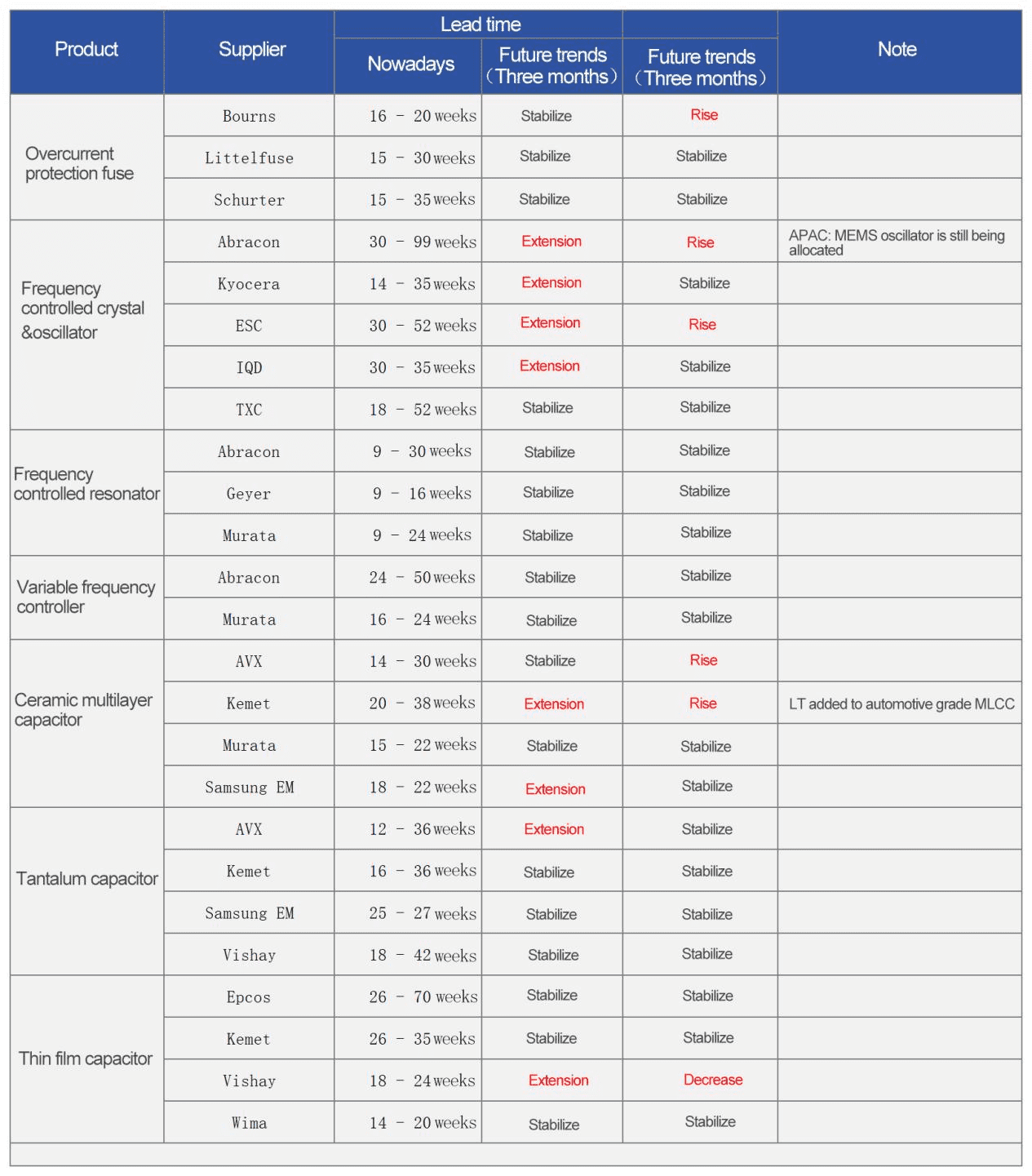

The prices and delivery times of Abracon's frequency controlled crystal and oscillator products are on the rise. In the Asia Pacific region, MEMS oscillators are still being allocated.

The delivery time for Epcos ordinary thin film capacitors at AP is 16-20 weeks. In contrast, high-power thin film capacitors still last for 26 weeks. Vishay's products such as inductors, chokes, and coils are expected to have lower delivery times and prices for their product lines. Bourns' inductor, choke, and coil product lines have maintained stable delivery times in the European Union and are expected to show a downward trend in the future.

Nichicon has cancelled the quotation for aluminum capacitors for all customers in the EU region, and has raised prices and extended delivery times for products in the Asia Pacific market with packaging sizes of 6.3x7.7, 8x10, and 10x10.

Overall, in terms of the supply chain, the lead time of semiconductor products is shortening, and the off-season of the passive component market is slowing down, although inventory adjustments are still ongoing. In the medium to long term, benefiting from the three major markets of AI/5G communication and automotive electronics, the industry is generally optimistic about strong market demand in the second half of the year and continues to be optimistic about the passive component market in 2024.

In addition, in terms of capital expansion and product layout, Vishay has increased its capital expenditure this year to $385 million, an increase of $60 million compared to 2022. Two thirds of these expenses are used for capacity expansion projects. It is expected that Vishay will gradually release production capacity and shorten product delivery cycles in the second half of 2023 and the first half of 2024.

Unlike in the past, Vishay's expansion areas are concentrated in wafer fabs in Germany, Taiwan, China and Italy. At the same time, the product is biased towards MOSFETs and other products applied in the automotive and industrial fields.

In terms of automotive business, Murata stated that traditional cars use 3000 multilayer ceramic capacitors (MLCCs) per vehicle, while pure electric vehicles that support autonomous driving will carry more than three times the quantity. Murata's goal is to expand the sales of automotive MLCCs, so that over 30% of the company's sales in the medium to long term come from automotive products.